|

Hey Female Founders...It's Time To:

Take Control, Get Funded, and Build a Business That Thrives

You’ve been told to avoid debt, but the real danger is running a business without financial security. Discover how to build a system that protects your business, keeps you prepared, and gives you the flexibility to grow—without risking your personal finances.

You’ve worked hard to build your business, but if you’re only relying on cash or a debit card alone, you’re leaving yourself exposed. Unexpected expenses, missed opportunities, and financial challenges can put everything at risk—and personal guarantees only make it worse. Successful entrepreneurs do it differently—they create systems, leverage tools, and get obsessed with the financials in their business. That’s where we come in.

The Hidden Risks Most Business Owners Don’t See

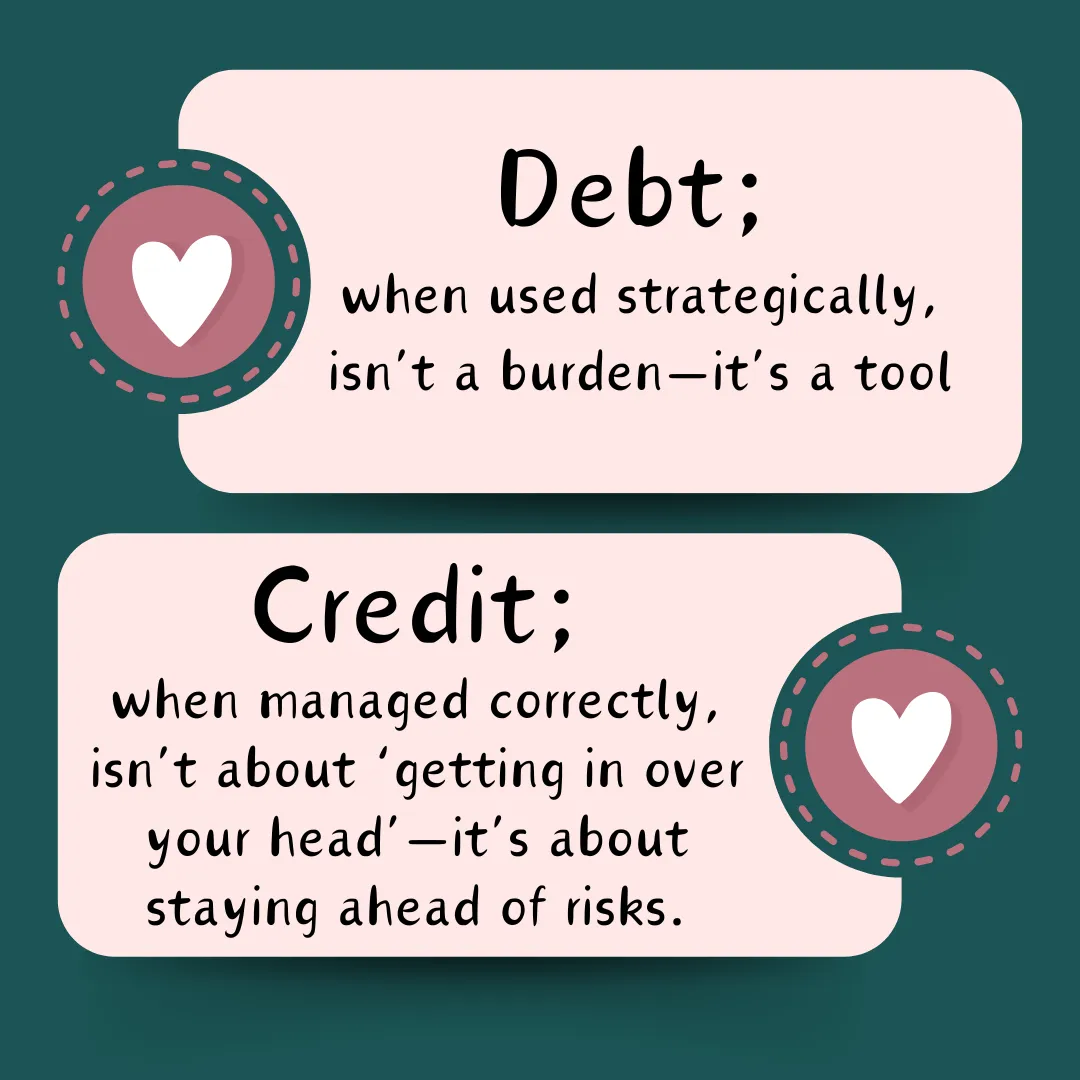

The Debt Myth:

You’ve been told debt is bad, but without access to strategic funding tools, you’re stuck with financial bottlenecks.

Personal Guarantees:

Many funding options require you to put your personal finances on the line, tying your business’s risks to your personal credit.

Cash-Only Risks:

Pride in a cash-only business is costing you time, security, and growth opportunities you don’t even know you’re missing.

The Tools to Build Financial Security and Strategic Growth

You don’t need more financial risks—you need smarter systems

That’s why we focus on helping you create financial security, flexibility, and confidence with tools that support your business goals, not jeopardize them.

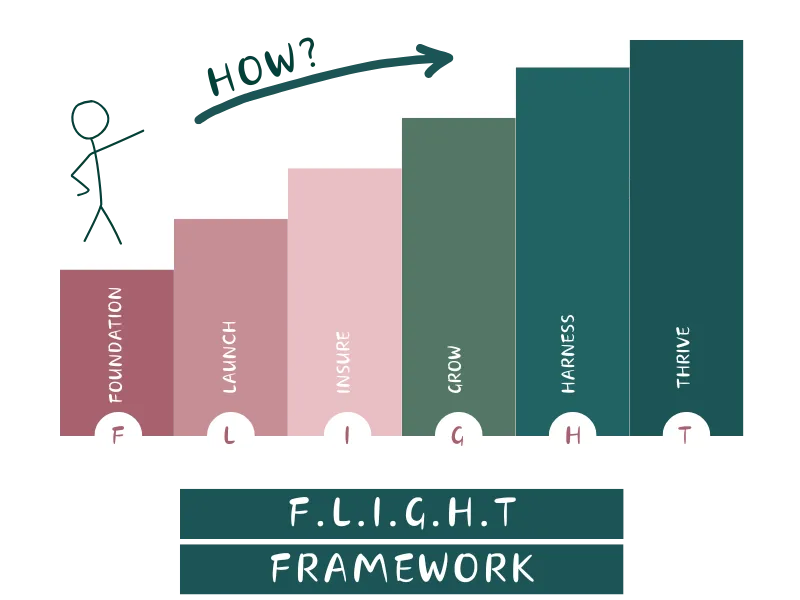

Foundation:

Build a secure financial foundation that keeps your personal finances safe and prepares your business for funding.

Launch:

Use initial tools like vendor accounts, retail-specialty accounts to cover early-stage needs and to create momentum without unnecessary risk.

Insure:

Establish a safety net with flexible funding options like lines of credit, and no PG business credit cards so you’re always ready for the unexpected.

Grow:

Leverage advanced tools like loans, grants, revenue and PO lending strategically, ensuring they fuel growth without sacrificing security.

Harness:

Optimize and refine your financial systems for efficiency, ensuring you’re prepared for long-term success with redundancy and flexibility.

Thrive:

Operate with clarity, confidence, and the knowledge that your finances align with your vision.

Why ‘Debt-Free’ Isn’t Always Free

Avoiding debt feels safe, but the truth is it’s costing you time, growth, and security.

discover your business's Financial Power play

Turn challenges into opportunities, build a resilient business, unlock growth, and enjoy the journey!

Your business has unique potential—find your financial edge and thrive.

Your Business Deserves More: with the F.L.I.G.H.T Framework, our cutting-edge software, and expert coaching, you’ll build the financial foundation to fund your business, protect your personal finances, and scale confidently

Get Funded, Stay Flexible, and Scale with Confidence

Improve Your Business Fundability For Better Funding Options

Elevate your business's fundability to access better funding options. Identify and fix issues to qualify for more favorable credit lines & terms.

Unlock High-Limit Business Credit Lines in Your Business Name

Secure high-limit business credit lines in your business EIN and improve your business credit profile for better loan options.

Access Every Credible Business Lending Option Available

Increase your funding options with access to every credible business lending option, including both alternative & traditional lenders.

On Demand One-on-One Advisor Support

Our expert Business Credit Advisors offer personalized support to help overcome obstacles & secure the best financing terms.

Your going to love the results

Sofia Yen

Before working through with this program, I felt stuck and constantly worried about my business finances. I was using personal savings to cover everything, which left me feeling drained and anxious. But after securing $150k business credit and building a safety net, everything changed. I finally feel confident and in control of my business. I can take risks without that fear of losing everything. Prosperly's system didn’t just help me with credit—it gave me peace of mind and the freedom to grow.

Emma Johanson

Working with Prosperly gave me the truth I needed to hear—my business was in a vulnerable state. I’ve felt that stress in my gut for a while, but seeing it laid out so clearly gave me the push I needed. The clarity was refreshing, and it didn’t just stop there. It left me feeling ready and energized, knowing there’s a clear solution to move forward. Game-changer for me! The clarity feels incredible.

Maya Mitchell

I used to lie awake at night stressing about how I’d handle unexpected expenses. I didn’t realize how much mixing personal and business finances was holding me back and exposing me. This program taught me how to build business credit and gave me a financial foundation that felt secure. Now I have the resources to scale my business without fear. It’s not just about the credit—it’s the confidence I’ve gained to think bigger and go after what I really want.